The GMAR recently conducted a survey of homeowners in the Greater Milwaukee area to ask about their opinion on the real estate market.*

Buyers are in the market

The GMAR survey showed that 77% of homeowners believe that now is a good time to buy a home, and 58% believe homes are selling fast, based on what they’ve seen in the news. As the Association has reported, inventory levels were well under 3 months and prices were rising in recent quarters, revealing strong demand in the market, fueled by first-time buyers. Buyers have been gobbling up virtually every property listed, particularly those in good condition and priced under $350,000.

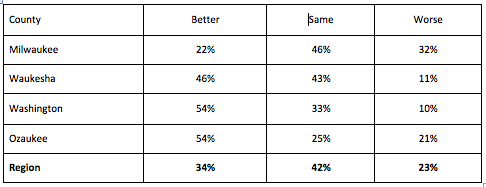

Regional Economy is Strong

Over 75% of homeowners believe the regional economy is getting better or staying the same. Ozaukee and Washington Counties are leading with 54% of residents in both counties feeling that the economy is getting better.

Unsettled Issues

The survey showed 17% of homeowners, almost 1 in 5, are interested in selling their home in the next 12 months (6% are “very likely” to sell, and another 11% are “somewhat likely” to sell). If the 6% who said they are “very likely” to sell do, in fact, sell their home, it would total approximately 22,172 home sales. In 2016, a year also marked by tight inventory, the market saw just over 21,000 unit sales. Brokers are hoping that a sizable number of the 11% who are “somewhat likely” to sell, take advantage of the market.

However, sellers have a few issues they’re waiting to see settled before they list their homes. While they know buyers are out in force, prices are rising, and the regional economy is performing well, they are in a “wait and see” mode.

Concern about Washington DC

Home ownership is a “life decision,” and there are numerous quality of life issues that impact an individuals or family’s decision to purchase a home. Typically, those factors are questions of finding the right house in a good neighborhood, looking for a good school district, how far a neighborhood is from work, the cost, etc. Issues that squarely and logically relate directly to homeownership.

However, in our survey, typical “life decisions” have taken a backseat to developments in Washington DC. When asked, “What would worry you most when it comes to buying a home in the next 12 months?” 50% of respondents ranked, “I’m afraid of what is going on in Washington DC right now,” with a 4 (14%) or 5 (36%) out of 5. Some of the homeowner-related issues being discussed in Washington DC that might impact them include: tax policy, deductibility of mortgage interest, and health care.

Public Opinion Strategies, the firm that conducted the survey, called the level of concern among homeowners about what is happening in Washington DC, “unprecedented,” but also something they are seeing in many areas of the country.

The next closest issue was, “I don’t think I could sell my current home for enough,” coming in at 32% (14% ranked it 4, and 18% ranked it 5).

On the other end of the spectrum, 62% gave a 1 (the lowest ranking, noting very little worry) for concern about their job situation, 74% gave a 1 for getting a loan, 73% gave a 1 for having to move to keep a job, and 61% gave a 1 or a 2 to not being able to afford a new home. Again, reinforcing the perception that the regional economy is strong.

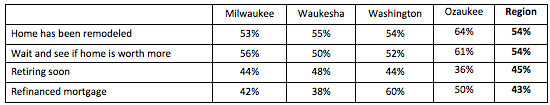

No Need to Hurry

Homeowners who have made it through the Great Recession are in a somewhat comfortable position and are being cautious with the equity in their home. Reasons for not selling their home include the fact that many, did a little remodeling in the last few years (54%), refinanced their mortgage with rates at historically low levels (43%), or are looking at retiring soon (45%). They also are bullish on the future of the market; 54% said that with prices still increasing, they want to see if their home will be worth more.

This population is holding in place for a while longer until they see what kind of policies come out of Washington and how they will impact them, with no sense of urgency to sell due to local conditions.

Supply Problems

Another major problem for potential sellers, is that they are looking to downsize their dwelling. This makes sense in the Milwaukee market with a large Baby Boomer population that is looking at, or actively pursuing, downsizing. 58% of homeowners would look for a new home in suburban communities, 23% in rural areas and 18% in an urban environment. 80% of owners would want to move somewhere near their friends and family (43% rated this criteria as very important).

What type of dwelling do they want? 60% say a condo or smaller home. This is very problematic for our region where new home construction is still catching up to its pre-recession production, yet apartment construction continues unchecked. There is a large disconnect between the types of housing currently being developed and what the market is calling for.

Wisconsin is historically known as a high property tax state, and 59% of homeowners in the region believe their property taxes are too high. Some of that sentiment may be related to property values increasing in the last few years. Increasing values often lead to a higher tax bill.

* Public Opinion Strategies conducted the survey of 500 homeowners with 250 phone & 250 online surveys in the Greater Milwaukee area. The survey was conducted May 16-18, 2017 and has a margin of error of ±4.38%. Gene Ulm was the pollster and primary researcher on the project. Caitlin Reed was the project director and Ryan Garikes provided analytical support.

Source: myemail.constantcontact.com